Problem Statement

ABC Lending Co., a mid-sized financial institution specializing in personal and small business loans, is experiencing significant challenges due to its due to its outdated and poorly managed client financial data, life event plans, and loan management system. Over the past year, their customer base has grown by 40%. However, the company’s existing financial data and loan processing system has failed to scale effectively, leading to the following critical issues:

Lack of Unified View of Financial Data:

- Advisors do not have a consolidated view of important financial data, such as multi-generational relationships, shared accounts, and financial goals.

- This lack of visibility leads to inefficiencies in financial planning and delays in delivering timely services to clients.

Struggles to Meet Service Level Agreements (SLAs):

- The institution is unable to consistently meet SLAs for case resolution.

- This results in customer dissatisfaction and missed opportunities to proactively address client needs

Missed Growth Opportunities:

- The institution is unable to accurately track and understand clients’ financial goals.

- This leads to missed opportunities for identifying new financial products and services that could benefit clients.

Inefficient Client Onboarding:

- There are no repeatable, standardized processes for onboarding new clients.

- This inefficiency hinders the institution’s ability to scale and deliver a smooth, seamless experience for new clients.

Inefficient Loan Processing:

- Heavy reliance on manual workflows requiring loan officers to navigate between spreadsheets, emails, and disconnected systems.

- Increased processing times and higher error rates.

Inconsistent Eligibility Assessment:

- Manual calculations and subjective judgment lead to inconsistent decisions and delayed approvals.

Lack of Scalability:

- Current systems cannot handle the growing volume of applications, limiting the company’s ability to introduce new loan products and serve a larger customer base.

Communication Gaps:

- Without comprehensive systems and processes in place, the institution struggles to maintain timely, relevant communication with clients.

- This ultimately affects both customer satisfaction and the institution’s ability to foster growth.

Proposed Solution

To address these challenges, ABC Lending Co. should implement an integrated solution leveraging Salesforce Financial Services Cloud (FSC), OmniStudio, and other cutting-edge technologies. This comprehensive solution will enhance financial planning, streamline loan processing, improve case resolution, and enable growth. Below are the key components of the solution:

1. Consolidated Financial Data Management

- Salesforce FSC Household Data Model: Implement a unified household data model to map family relationships, shared financial accounts, and goals. This will provide advisors with a comprehensive view of the household’s financial situation, enabling more personalized advice and streamlined decision-making.

2. Efficient Case Resolution

- SLA Tracking & Automated Case Escalation: Automate case resolution workflows and escalate cases when SLAs are at risk to ensure timely resolution of client issues and maintain high levels of customer satisfaction.

- Omni-Channel Case Management: Implement Omni-Channel routing to assign service requests to the appropriate teams based on expertise and availability. This ensures that clients’ cases are handled by the most qualified personnel and processed efficiently.

3. Client Goal Tracking and Opportunity Creation

- Financial Plans and Goals Tracking: Use Financial Plans and Goals objects in Salesforce FSC to track clients’ short-term and long-term financial objectives. By monitoring progress and identifying gaps in clients’ financial plans, ABC Lending Co. can create new opportunities to meet those goals, thus fostering stronger client relationships.

- Standardized Action Plan Templates: Develop reusable action plan templates to streamline client onboarding and goal-setting processes. This will reduce inconsistencies, improve efficiency, and enhance both client and employee experience.

4. Improved Client Interaction Management

- Interaction Summaries: Leverage Interaction Summaries in Salesforce FSC to capture structured, actionable notes during every client interaction. These insights will help advisors deliver more personalized services and ensure clients’ needs are better understood and addressed in subsequent meetings.

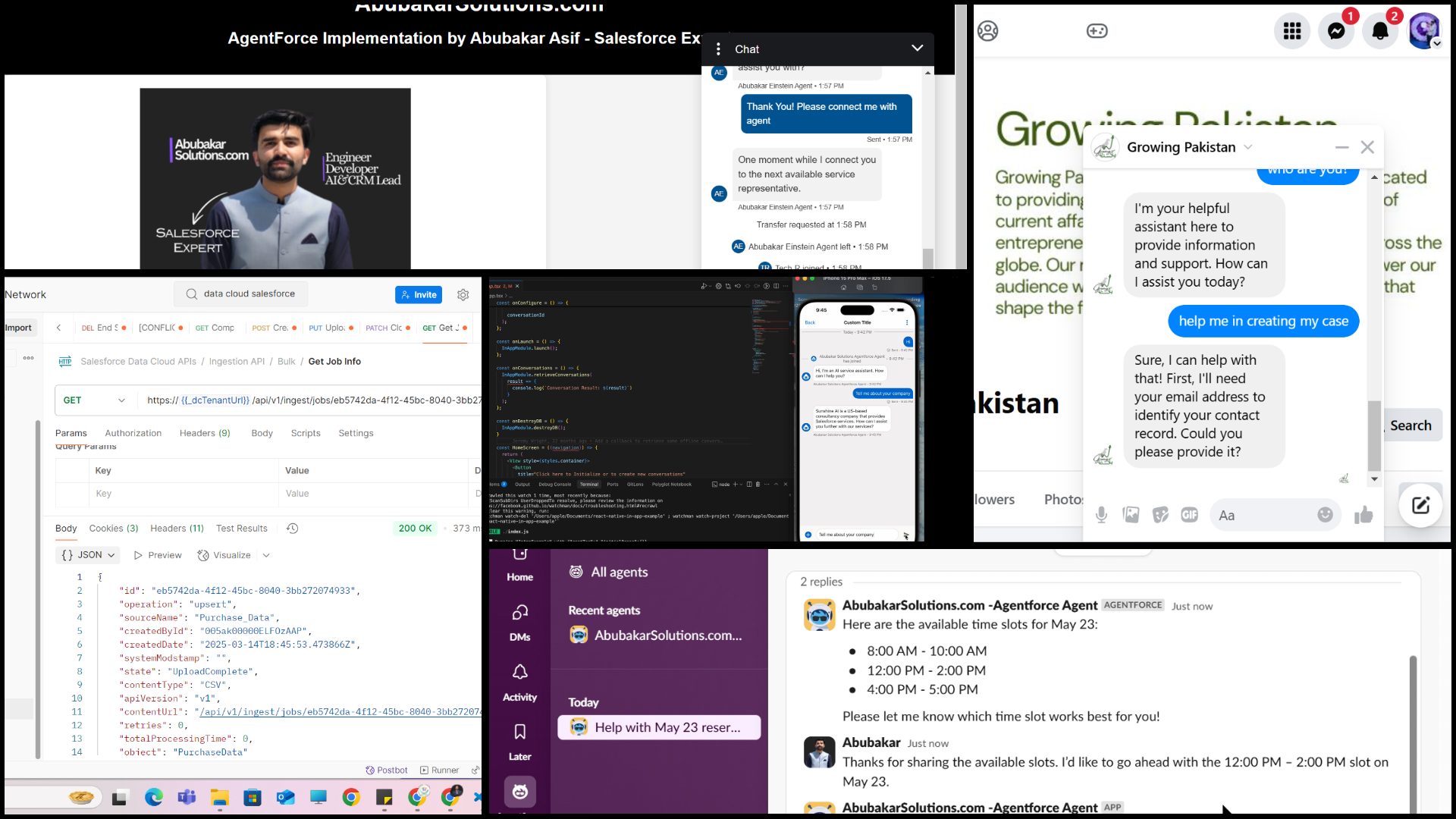

5. Streamlined Loan Application System Using OmniStudio

- OmniScript Guided Loan Application Process: Utilize OmniStudio to build a step-by-step guided loan application process, ensuring that service reps collect and verify the necessary customer data efficiently.

- Loan Details Collection: Collect key details such as loan amount, term, type, income, expenses, and debts.

- Automated Loan Eligibility Assessment: Use Business Rule Engine (BRE) to automatically calculate loan eligibility based on financial data and the customer’s profile. This eliminates errors and provides consistent, objective loan decisions. Loan Amount, Interest Rate, and Repayment Terms Calculation: The BRE will also calculate loan amounts, interest rates, monthly payments, and repayment periods based on eligibility criteria.

6. Automated Loan Processing

- Business Rule Engine (BRE): Use a master expression set in BRE to handle complex loan processing calculations, ensuring that the decision matrix evaluates all necessary criteria to determine eligibility, loan amounts, interest rates, and repayment periods.

- Data Transformation and Record Creation: Leverage Salesforce’s data mapping tools to transform and store customer data in a standardized format. New loan applications will be tracked as Salesforce records, ensuring seamless integration with other systems.

7. Post-Loan Process Automation

- Automated Notifications and Updates: Integration procedures will send automatic notifications to customers, managers, and service representatives regarding loan status updates (approval, rejection, etc.). It will also keep related Salesforce records, such as customer profiles and loan applications, updated.

- Seamless Salesforce Integration: The solution integrates all loan processing steps with Salesforce objects such as Leads, Opportunities, and Accounts, ensuring that all data is synchronized and up-to-date.

8. Scalability and Compliance

- Scalable System Architecture: The automated loan management system will scale as the customer base grows, supporting increased demand for loan processing and offering flexibility for future product offerings.

- Compliance Risk Reduction: Automated document verification and data handling ensure that regulatory compliance is maintained across all loan applications.

9. Real-Time Access and Enhanced User Experience

- Lightning Web Component (LWC): Deploy the loan eligibility check and processing workflow as an intuitive LWC, accessible directly within the Salesforce interface for service representatives. This will allow them to interact with clients in real-time, improving both loan processing speed and customer experience.

By implementing these technologies and processes, ABC Lending Co. will improve the efficiency of its loan application and approval process, increase customer satisfaction, and position itself for sustainable growth.