Problem Statement

ABC Lending Co., a mid-sized financial institution specializing in personal and small business loans, approached Abubakar with a pressing challenge in their loan application and approval process.

Over the past year, their customer base has grown by 40%, leading to a significant increase in loan applications. However, their existing loan management process is unable to keep up with this demand. This has resulted in operational bottlenecks, frustrated customers, and a loss of potential business.

Key Issues Identified by Abubakar:

- Inefficient Loan Processing: The current process is heavily manual, requiring loan officers to switch between spreadsheets, emails, and multiple disconnected systems to gather and verify applicant data. This increases processing times and the likelihood of errors.

- Limited Visibility for Customers: Customers often complain about a lack of communication during the loan approval process. They have no way to track their application status, leading to dissatisfaction and loss of trust.

- Inconsistent Eligibility Assessment: Loan officers rely on manual calculations and subjective judgment to determine eligibility, resulting in inconsistent decisions and delayed approvals.

- Compliance Risks: The manual process increases the risk of non-compliance with regulatory requirements, especially when it comes to document verification and data handling.

- Lack of Scalability: The company’s current system is unable to scale with the increasing number of applications, limiting its ability to serve more customers or introduce new loan products.

Requirements:

Omnistudio Permission Set License

- The Omnistudio Admin permission set license has been renamed to Omni Studio.

Includes two permission sets: Omnistudio Admin (full CRUD access) and Omnistudio User (Read access).

- Available for Salesforce Enterprise, Unlimited, or Performance Editions.

Business Rule Engine

- Available in Enterprise, Unlimited, and Developer Editions with Business Rules Engine enabled permission set license.

- User Permissions Needed

- Rule Engine Designer: Required to create, update, and delete decision matrices and matrix versions.

- Rule Engine Runtime: Required to use decision matrices in Business Rules Engine.

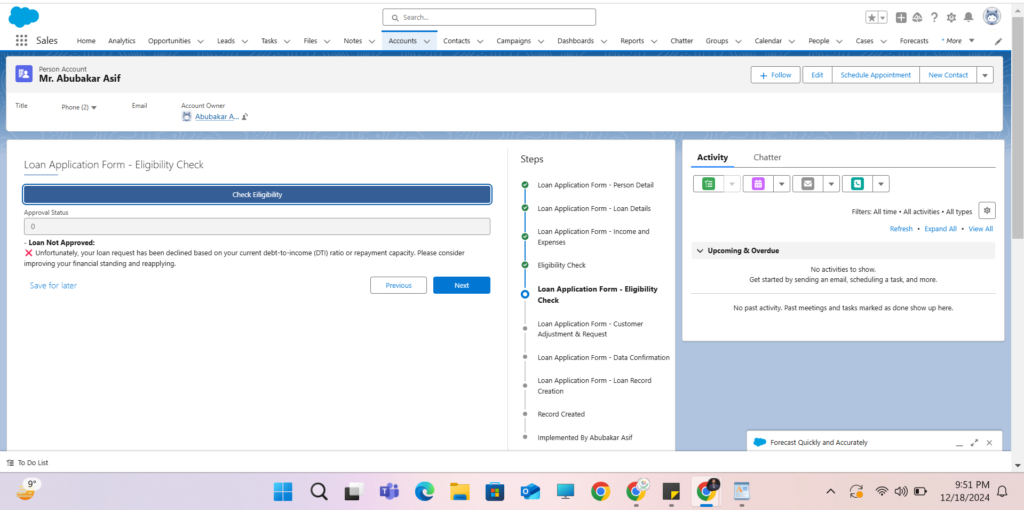

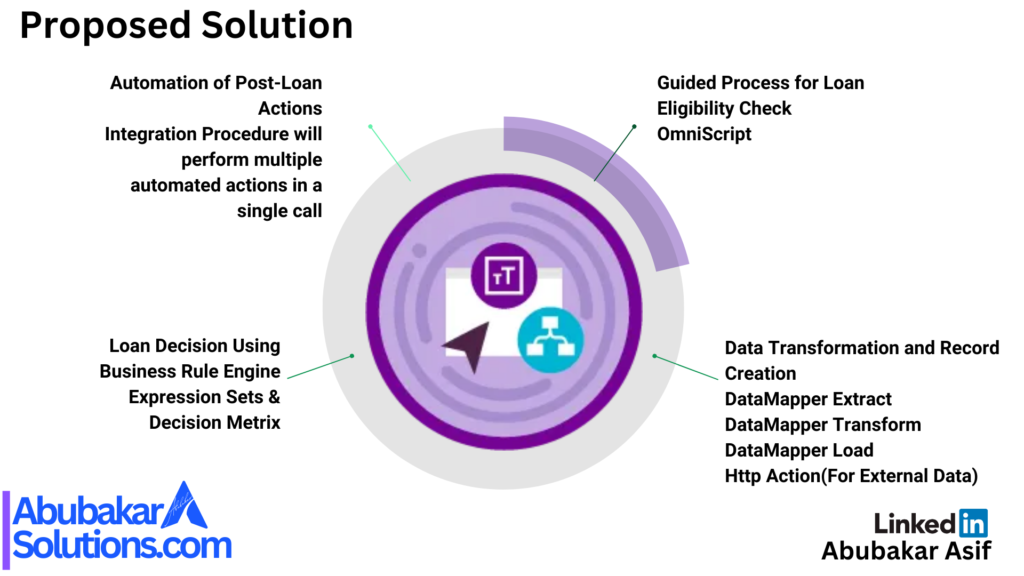

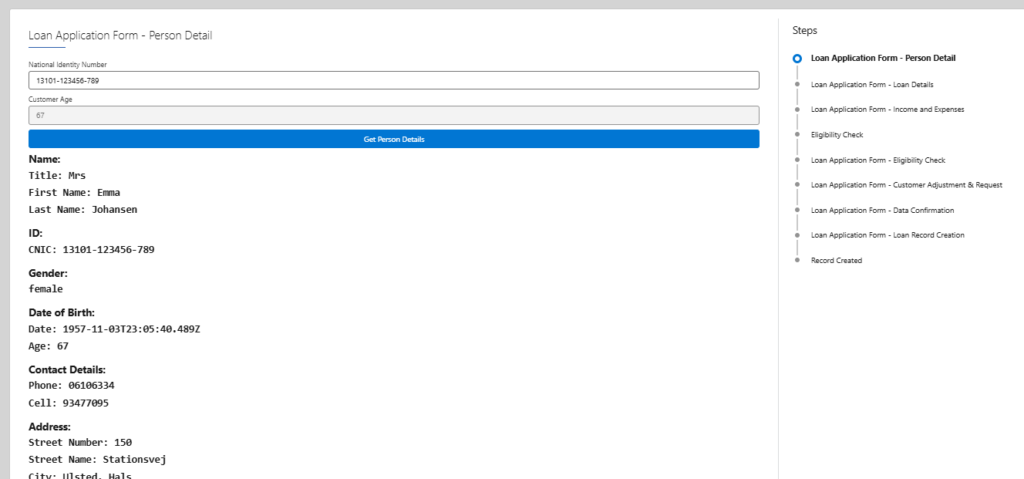

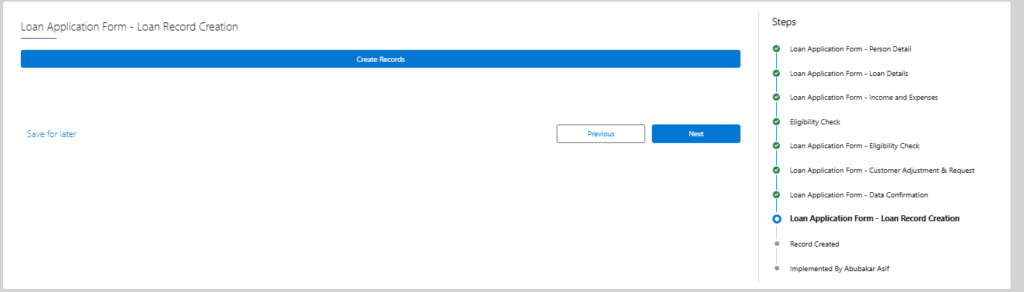

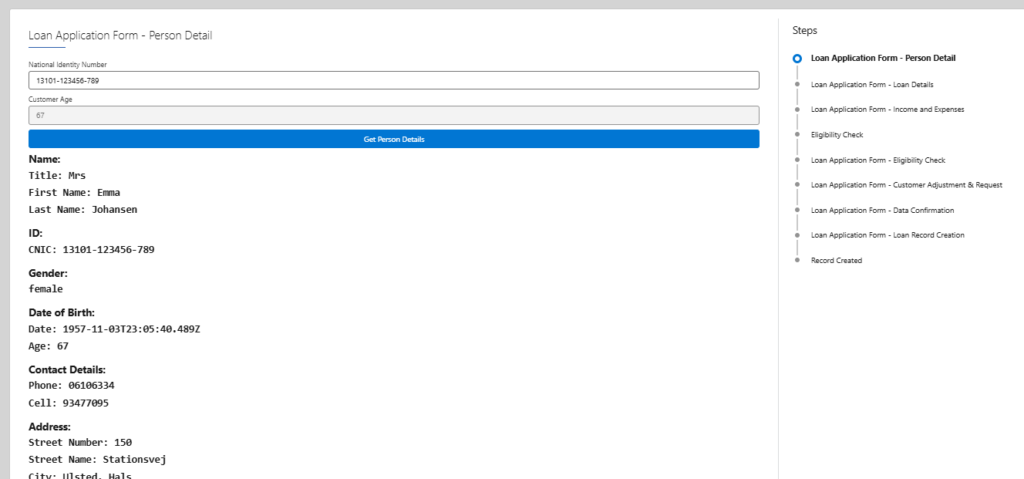

Step 1: Guided Process for Loan Eligibility Check

Overview:

OmniScript creates a guided process for service reps to collect and verify customer information before proceeding with the loan application.

Scenario:

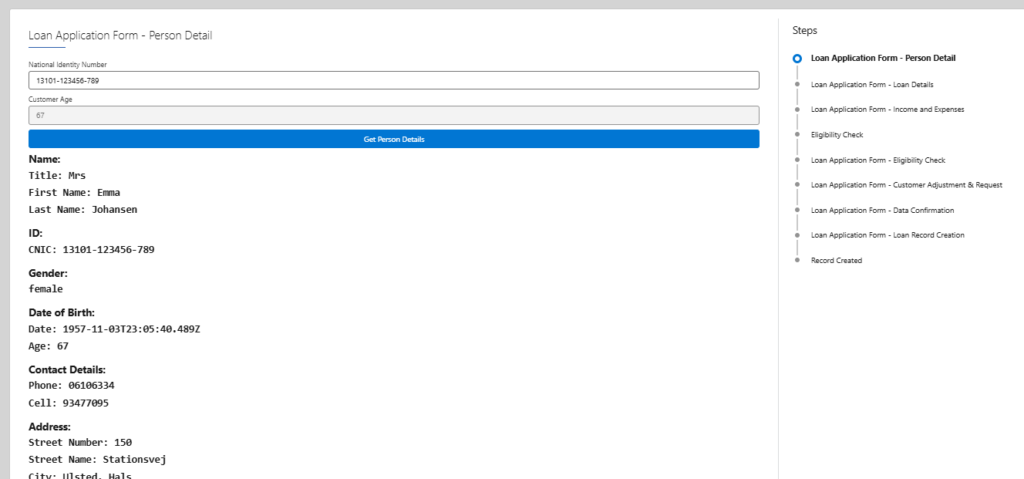

Collect Customer Identity:

The service rep asks for the Customer Identity Number (CIN).

Example: “Please provide your Customer Identity Number.”

Retrieve Customer Data:

An Integration Procedure calls an external API to fetch the customer’s data (e.g., name, address, date of birth, phone number).

Verify Customer Identity:

The service rep asks the customer to confirm specific details from the retrieved data for verification.

Example questions:

“Can you confirm your date of birth?”

“Is your address 123 Maple Street, Springfield?”

“Please verify your phone number.”

Once verified, the process moves to the next step in the loan application.

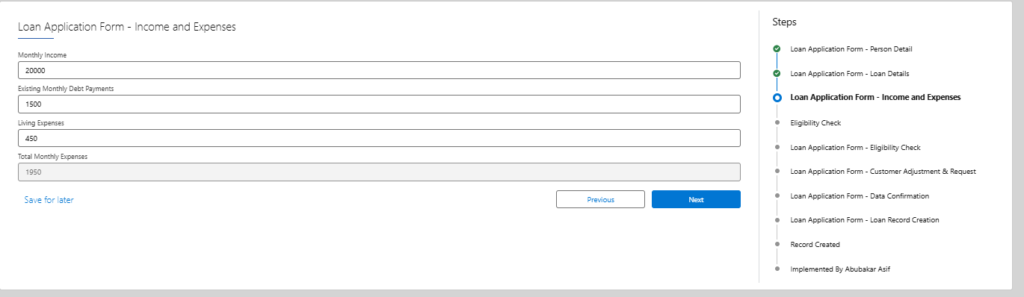

Step 2: Data Collection via Guided Process

Once the customer’s identity is verified, the service rep will use the OmniScript to gather the necessary loan-specific details:

- Loan Amount Example: “How much would you like to borrow?”

- Loan Term Example: “What loan term are you looking for? (e.g., 12 months, 36 months)”

- Loan Type Example: “What type of loan are you applying for? (e.g., Car Loan, Home Loan, Personal Loan)”

- Monthly Income Example: “Can you provide your monthly income?”

- Monthly Debt Payments Example: “What are your current monthly debt payments?”

- Monthly Expenses Example: “What are your total monthly expenses (e.g., rent, utilities, groceries)?”

These details will be captured in OmniScript and processed to assess the customer’s eligibility and determine loan terms.

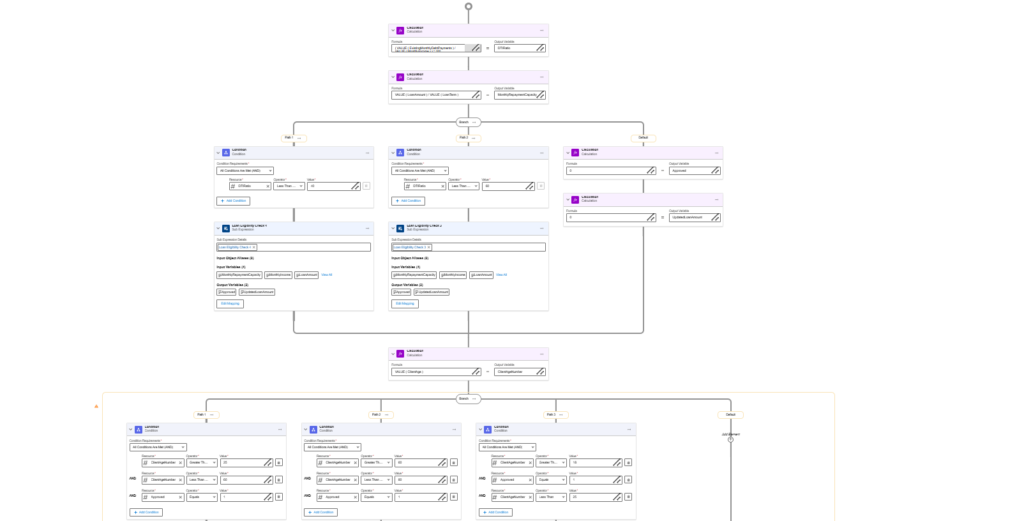

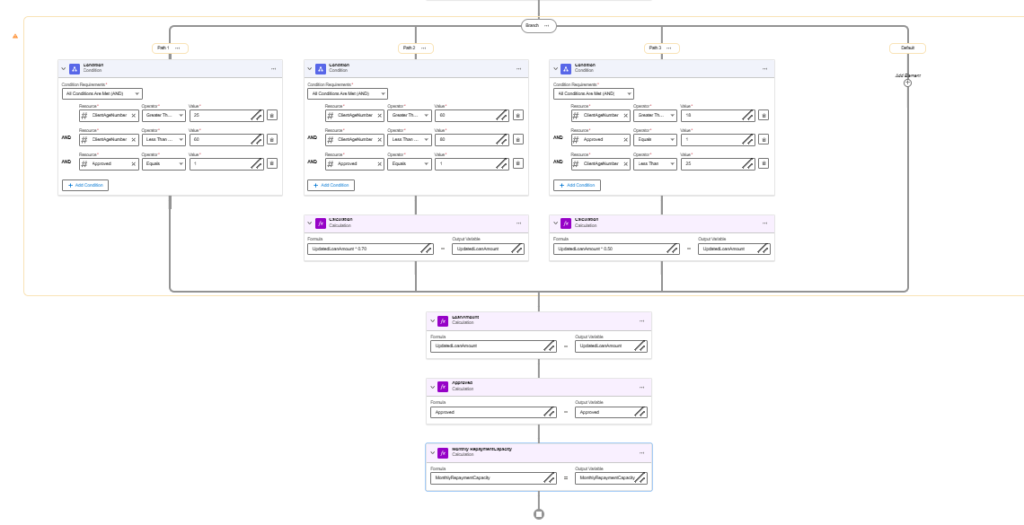

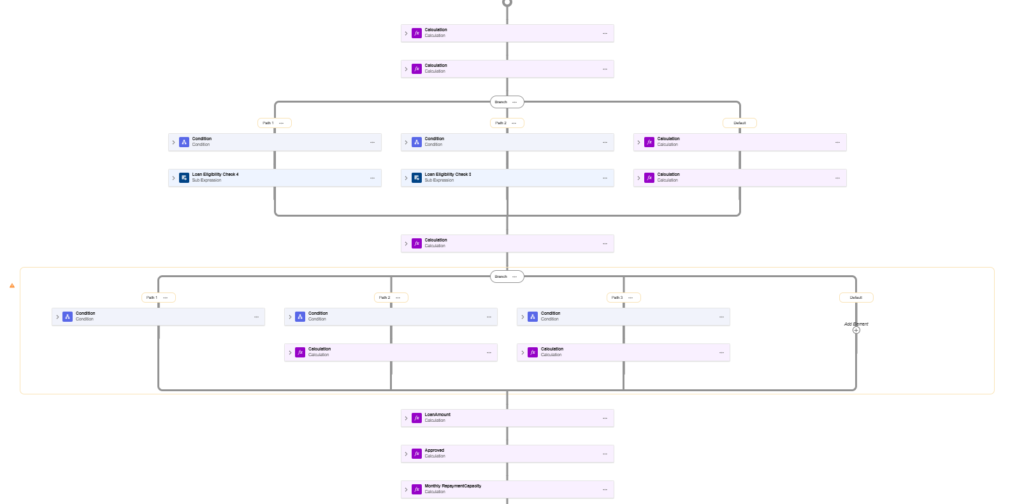

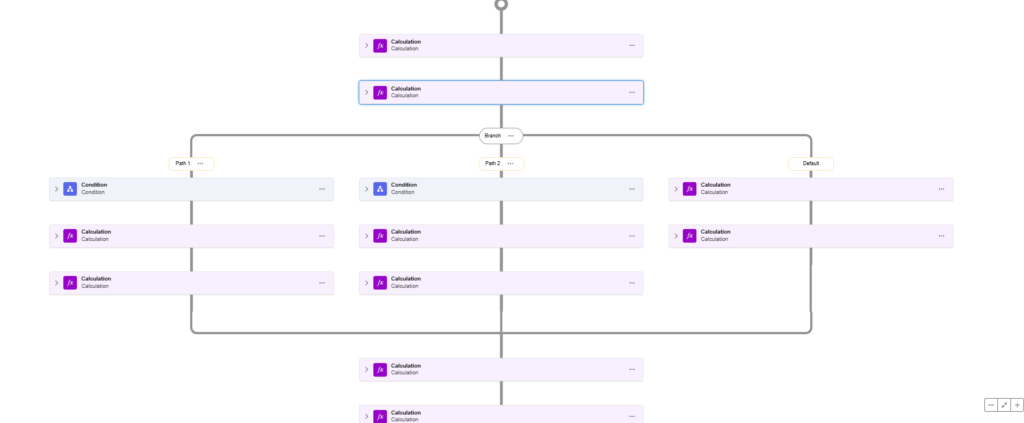

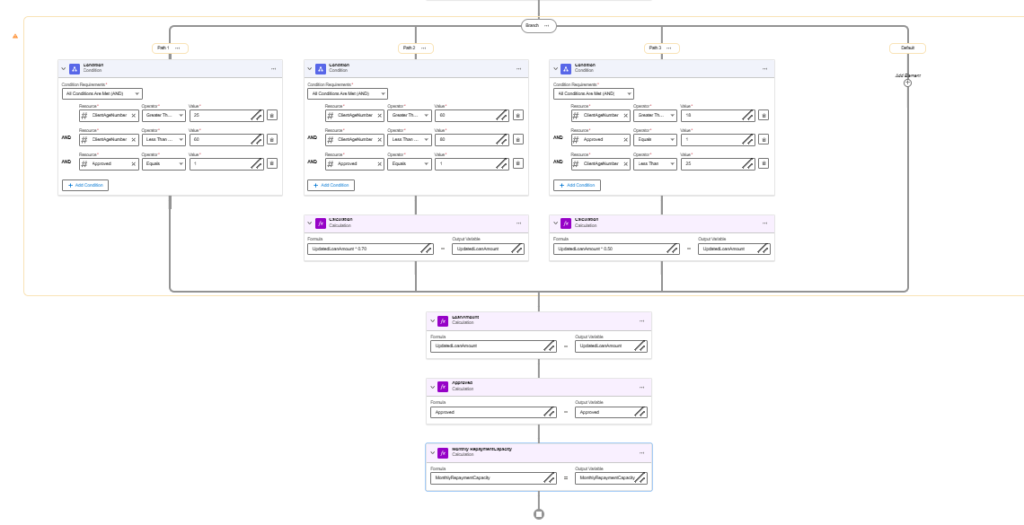

Step 3: Loan Decision & Complex Processing with Business Rule Engine (BRE)

The Business Rule Engine (BRE) will handle the complex loan eligibility processing using Expression Sets and a Decision Matrix.

Expression Sets:

A Master Expression Set is created that incorporates two sub-expression sets for detailed calculations.

Example sub-expression sets:

Eligibility Calculation: Based on customer financial data (income, expenses, debt).

Loan Amount Adjustment: Revises the loan amount based on the customer’s financial situation (e.g., income vs. expenses).

Decision Matrix:

The Decision Matrix evaluates multiple criteria to determine:

Loan Approval: Whether the customer qualifies for the loan based on eligibility calculations.

Loan Amount: Adjusts the loan amount based on the customer’s financial situation.

Interest Rate & Monthly Repayment: Calculates the approved loan’s interest rate and the monthly repayment amount.

This ensures that the loan decision is both accurate and aligned with the customer’s financial profile.

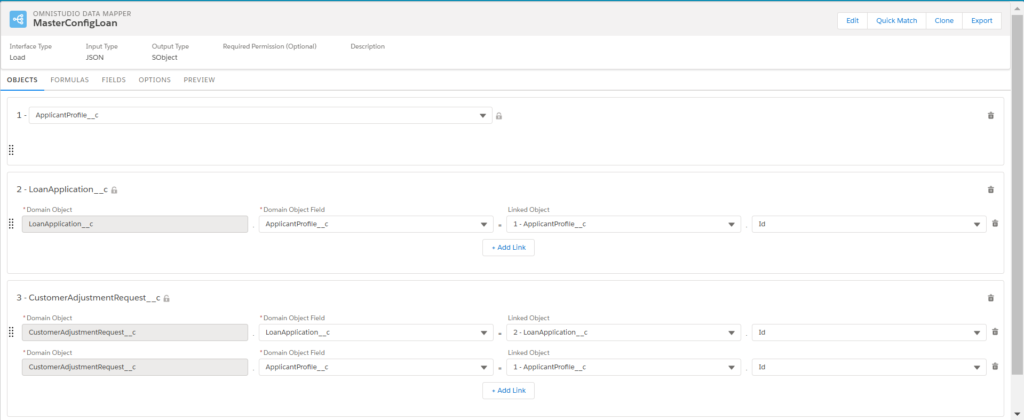

Step 4: Data Transformation and Record Creation

In this step, Data Mapper is used to process and transform customer and loan data:

Data Mapper Extract:

Purpose: Retrieve the customer’s data from external sources and transform it as needed for loan processing and record management.

Example: The customer’s personal data (name, contact information, financial details) is retrieved and formatted for use in Salesforce.

Data Mapper Load:

Purpose: Create new loan records and update the customer’s profile directly in Salesforce.

Example: New loan application and loan reconsideration records are created, storing relevant customer and loan details.

Data Mapper Transform:

Purpose: Consistently transform and map the extracted customer data into the correct format required by Salesforce.

Example: Customer data such as contact information, financial details, and loan terms are transformed to match the format needed for Salesforce records, ensuring consistency across systems.

Objects Created:

Customer Personal Data Object: Stores customer data for future use, such as marketing campaigns and future contracts.

Loan Application Record: Stores detailed information about the current loan application.

Loan Reconsideration Record: Stores data related to any revised loan applications after further review.

This structure allows for efficient data management, ensuring that customer data is consistently formatted and usable for future interactions, marketing, and reconsideration of loan terms.

Step 5: Automation of Post-Loan Actions

Integration Procedure will streamline multiple actions in a single call, automating several key tasks:

Automated Notifications:

The Integration Procedure will send notification emails to key stakeholders, including:

Manager – Updates the manager about the status of the loan.

Customer – Sends loan approval/rejection and other related details to the customer.

Assigned Service Rep – Keeps the service representative informed about the loan’s progress.

Update Related Salesforce Records:

The Integration Procedure will update key Salesforce objects to ensure that all records are synchronized:

Lead – Tracks the potential customer lead’s status.

Opportunity – Updates loan application opportunities based on the loan decision.

Account – Keeps the customer account updated with the latest loan information and status.

External API Call:

If needed, the Integration Procedure will make external API calls to fetch updated data from external systems (e.g., credit score updates, financial data, or other third-party systems).

Example: After loan approval, the procedure may request updated customer financial information from an external database to ensure consistency before processing the loan.

By leveraging Integration Procedures, this step ensures all processes are automated, notifications are sent, related Salesforce records are updated, and any necessary external data is retrieved, reducing manual effort and ensuring a seamless loan processing workflow.

Step 6: Deployment as LWC (Lightning Web Component)

Once the loan management process has been automated and integrated, the next step is to deploy the solution as a Lightning Web Component (LWC) to ensure seamless access for service representatives. Here’s how it works:

LWC Deployment for Easy Access:

The entire loan eligibility check and processing workflow, powered by OmniStudio, Business Rule Engine, and Integration Procedures, will be embedded in a Lightning Web Component (LWC).

The LWC will be designed to be intuitive and user-friendly, allowing service reps to access the guided process directly within the Salesforce interface without needing to navigate through multiple screens or tabs.

Real-Time Access During Customer Conversations:

Service reps can access the LWC in real time while interacting with customers, making the loan application process faster and more efficient.

During the conversation, the service rep will be able to:

Collect customer data (e.g., identity number, loan details, financial situation).

Verify identity using integrated data from external systems.

Calculate loan eligibility and approve/reject the loan using the decision matrix.

Generate loan records and update the customer’s Salesforce profile immediately.

Send notifications to stakeholders and update related Salesforce records seamlessly.

Enhanced User Experience:

The LWC provides a clean, responsive interface for service reps, allowing them to manage the loan process directly within the Salesforce platform.

It offers real-time feedback for both the rep and the customer, ensuring that all data is processed efficiently and consistently without any delays.

By deploying this solution as an LWC, the loan management process becomes easily accessible for service reps, improving their ability to provide quick and accurate responses to customers while also ensuring all necessary updates are made to Salesforce records and external systems.